Petty gifts on special occasion like Chocolates on Entity Milestone years Employees Gym Membership Subsidized mealssnacks to the extent of subsidy qualifies for staff welfare expenses Refreshments like Snacks beverages Employee Team Lunch Birthday and Festival Celebrations at. Importance of employee welfare Employee welfare raises the companys expenses but if it is done correctly it has.

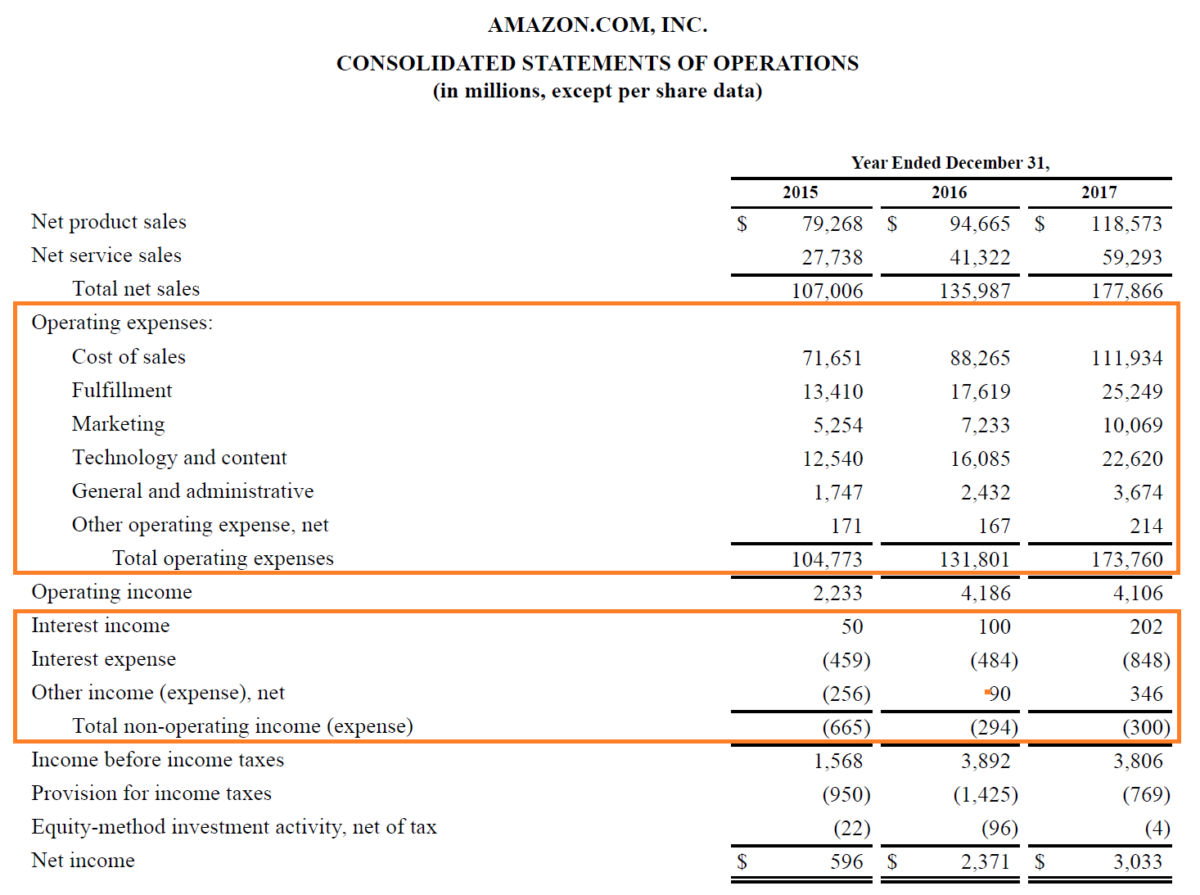

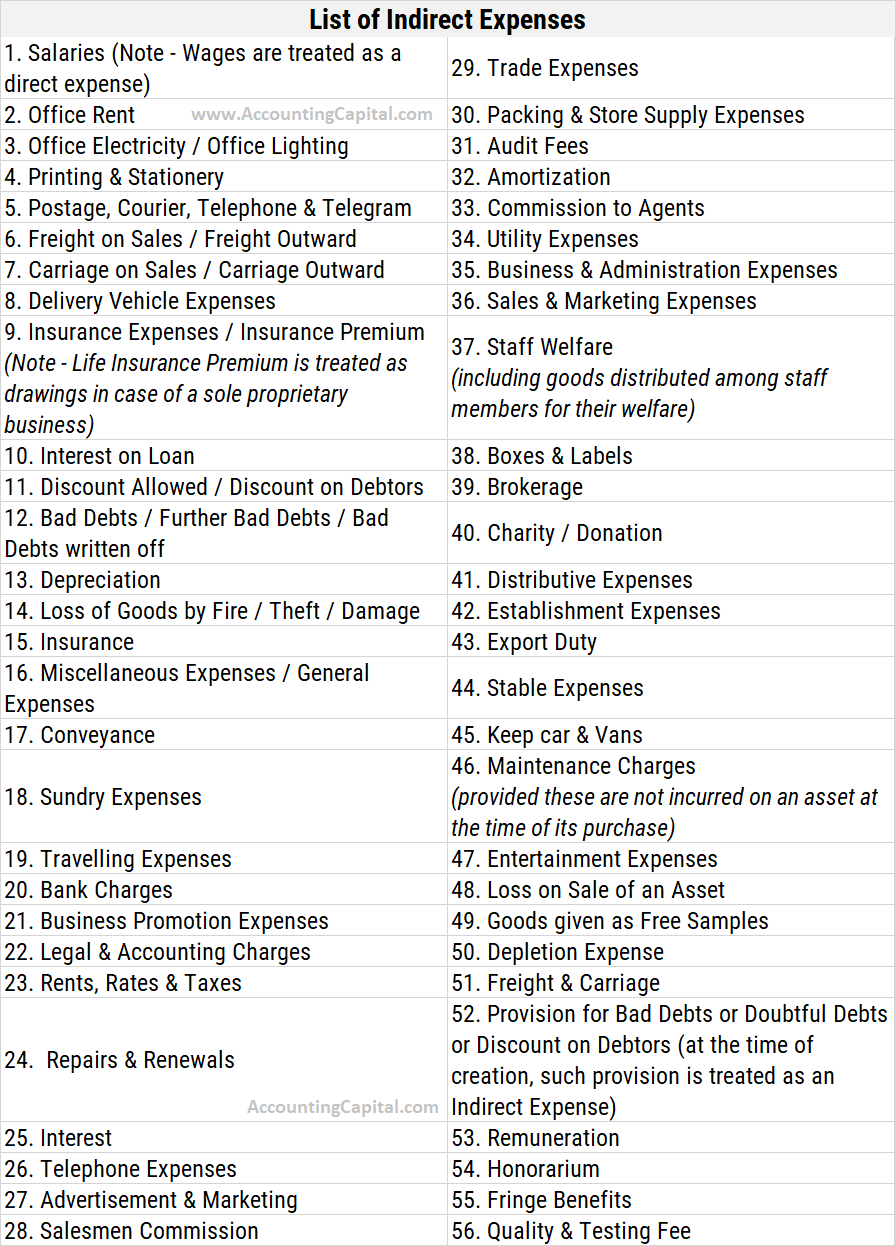

Expenses In Accounting Definition Types And Examples

Receiving Donation and Sponsorship.

. 20 of the QPE incurred. Allowable business expenditure us 37 - Offence for non-compliance of. Discounted Sale to Employees.

Under the Rules QPE refers to a capital expenditure incurred under paragraph 2 of Schedule 3 to the Income Tax Act 1965 ITA in relation to provision of machinery and equipment including ICT Equipment except motor vehicle. Any expenditure for the benefit of employees apart from their salary is commonly known as staff welfare expenses. Section 17 5 of the CGST Act puts restrictions on availment of ITC on many expenses especially where such expenses are incurred for the employees.

Welfare Measures inside the Work Place. Computers loaned to an employee. Reopening of assessment us 147 - Period of limitation to issue notice.

According to SARS tax-deductible business expenses are expenses incurred in the operation of a business. 2 An employee who has substantial interest ie. Carriage on Sales Carriage Outward.

Input Tax Credits under GST. Many companies offer some of the following employee benefits and perks. What are staff welfare expenses.

Coronavirus COVID-19 tests and equipment. Tyagi Of late a number of business entities have sought opinion in regard to the allowability of expenditure on. 80000 - 5000 75000.

To Staff Welfare Expenses. Entry to be passed. Interest Relating to Bank Deposit Loan Trade Debt.

The following employees are deemed as specified employees. Safety and cleanliness. These are the expenses that are paid by the company for their staff during their official.

31 March 2008 the expenditure which you are inurring for providing any benefit or facility to perform their. Credit debit and charge cards. List of Operating Expense under SGA Expenses 1- Telephone Expenses.

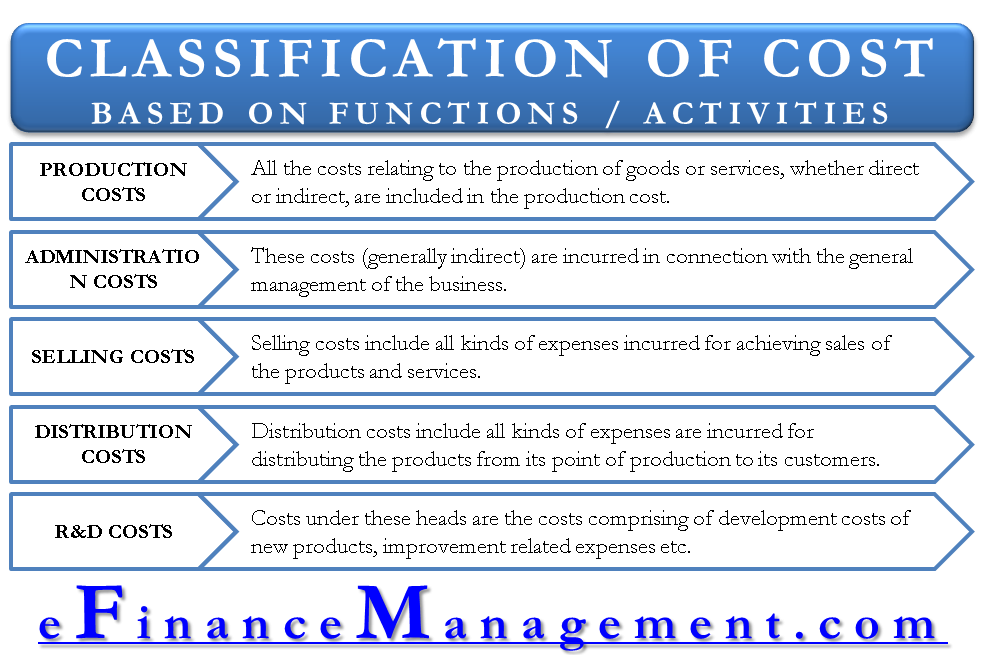

3 An employee whose monetary income under the salary exceeds Rs. Legal Expenses Paid to Advocate or Advocate Firm Sec 93 Applicable. Following is a list of some commonly seen indirect expenses.

Types of employee benefits and perks. Welfare measures inside the work place. Staff welfare expenses list Income Tax Goods and services Tax GST Service Tax Central Excise Custom Wealth Tax Foreign Exchange Management FEMA Delhi Value Added Tax DVAT SEZ Special Economic Zone LLP Limited Liability partnership Firm Trust Society Company Laws DTAA Notifications Circulars Case Laws Statutory Provisions Acts Rules.

40 of the QPE incurred. Generally monthly bills are payable. 2 Travelling Expenses.

Income minus deductible expenses Generally deductible business expenses are those wholly and exclusively incurred in the production of income. Full ITC of tax paid on RCM is available. What are the expenses that come in indirect expenses.

MANAS ROUT Expert Follow. The expenses those come in the debit side of the Profit Loss Account of the Company are all indirect expenses. Seeks to notify the provisions of.

31 March 2008 Any expense which relates to welfare of staff or for banefit of staff including refreshment which could not be shown as any other head like salary should be Dr. These are the cost incurred on a landline or mobile phone. In other words any purchase you make for the purpose of running your business counts as a business expense.

Expenses and income generated by employee. In simple words it. 3 Office.

An employer may also cater for employees welfare by monitoring their working conditions. Employee welfare means anything done for the comfort and intellectual or social improvement of the employees over and above the wages paid. Postage Courier Telephone.

Beneficial owner of equity shares carrying 20 or more voting power in the employer-company. Tax-deductible business expenses reduce the amount you pay taxes on. Income Subject to Tax Taxable Income.

However in many of such instances ITC is permissible where the expenses are incurred as per statutory requirement under the law. A comprehensive list of welfare activities on labour welfare into two broad groups namely. Office Electricity Office Lighting.

For example lets say you made R600000 during the. Salaries Note Wages are treated as a direct expense Office Rent. Packing Expenses Labour Applicable.

Capital gain - determination of cost of acquisition - Inasmuch as the. FAR 31205-13 Employee Morale Health Welfare Food Service and Dormitory Costs and Credits FAR 31205-14 Entertainment Costs Employee welfare and morale expenses are costs incurred on activities to improve working conditions employer-employee relations employee morale and employee performance. Accounting Treatment of Staff Welfare Expenses.

What all comes under staff welfare. Other forms of employee welfare include housing health insurance stipends transportation and provision of food. A Conditions of the work Environment.

Compulsory reverse charge for payment made to advocate or advocate firm. C Losses resulting from operating food services are allowable only if the non-Federal entitys objective is to operate such services on a break-even basis. Payment from Employee to Retain Gifts Received from Others.

Income generated from any of these activities will be credited to the cost thereof unless such income has been irrevocably sent to employee welfare organizations. Non-Business or Private Use of Business Assets. Expenses paid by cash or by cheque-Type of voucher to be prepared-Cash or Bank payment voucher.

For control purpose the sub heads may be created under staff welfare expense like tea refreshment expenses medical expenses personal accident expenses uniform expenses etc. Packing Expenses Material Applicable. Sale of Property by a Partner.

Allowability of expenditure on employees welfare Expenditure on employees welfare activities including education of children of the employees is allowable as a deduction Published in 405 ITR Journ p69 Part-3 SK. Freight on Sales Freight Outward. Welfare measures outside the work place.

List of Indirect Expenses.

Staff Welfare Expenses Carunway

Expense Report Template Track Expenses Easily In Excel Clicktime

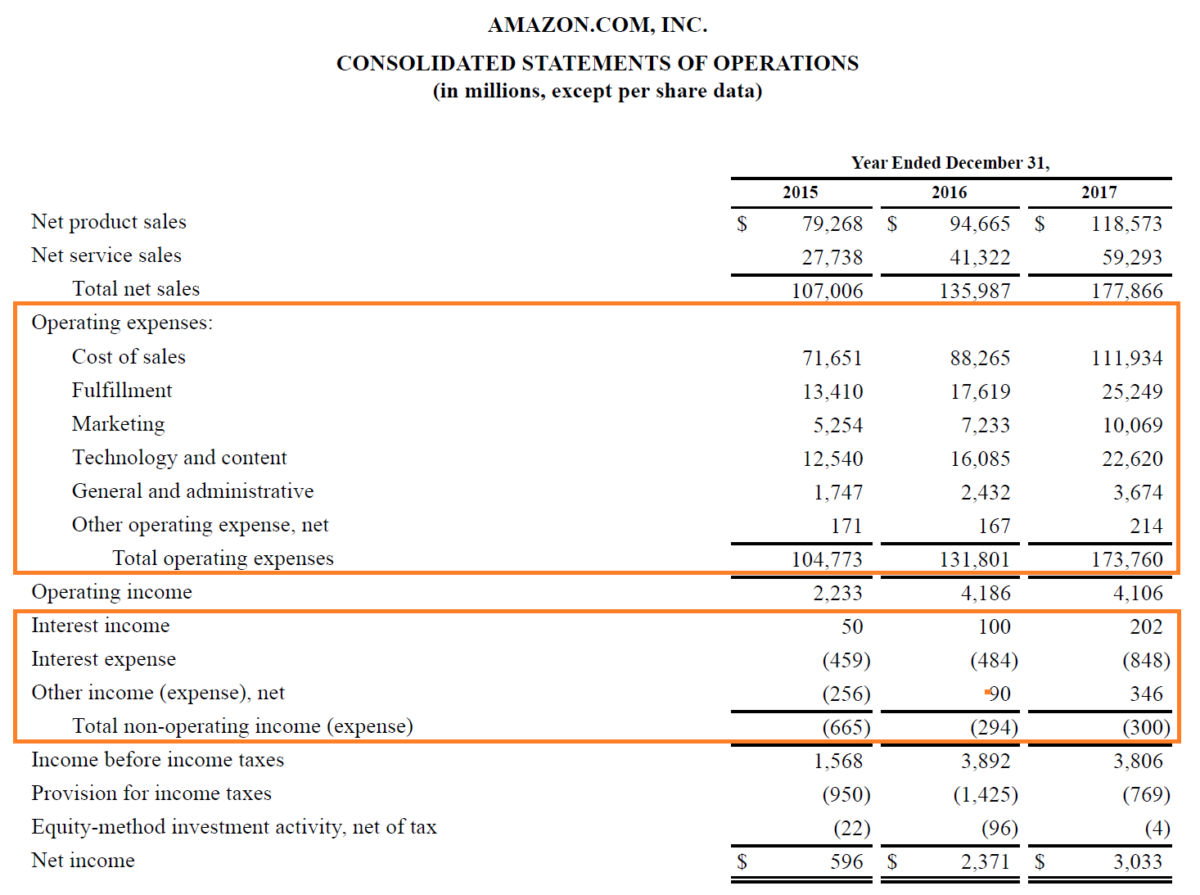

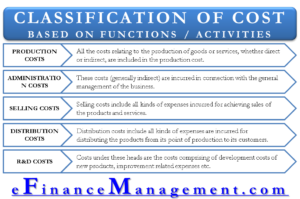

Classification Of Costs Based On Functions Activities Efm

What Is Direct And Indirect Expenses In Hindi प रत यक ष व यय और अप रत यक ष व यय क य ह Accounting Seekho

32 Important Pros Cons Of Welfare E C

:max_bytes(150000):strip_icc()/ScreenShot2022-03-23at10.03.24AM-d9cb8112a9624956a52fdf4355d60d50.png)

Above The Line Costs Definition

List Of Operating Expense Complete List Of Items In Operating Costs

What Are Functional Expenses A Guide To Nonprofit Accounting

The 7 Best Expense Report Templates For Microsoft Excel Teampay

List Of Indirect Expenses With Pdf Accounting Capital

Classification Of Costs Based On Functions Activities Efm

Tally Ledger Groups List Ledger Under Which Head Or Group In Accounts

Expense Report Template Track Expenses Easily In Excel Clicktime

The 7 Best Expense Report Templates For Microsoft Excel Teampay

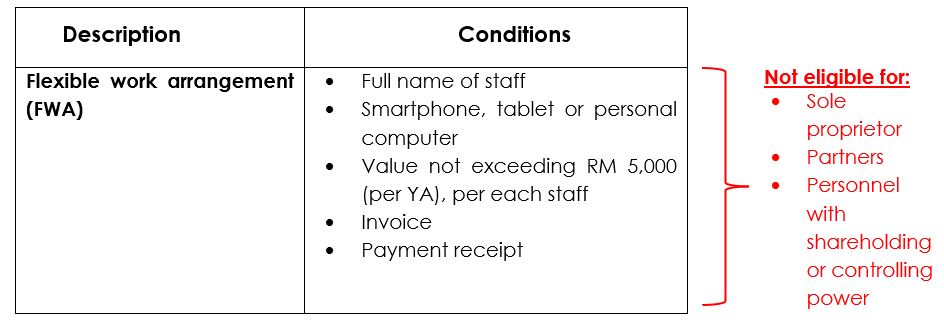

List Of Tax Deduction For Businesses Cheng Co Group

Expense Report Template Track Expenses Easily In Excel Clicktime

What Are Semi Variable Costs Bdc Ca

Dk Goel Solutions Chapter 1 Financial Statements Of Companies

Configuring Financials To Bring In Your Own Chart Of Accounts